Examining ESG #100 - Examining ESG at 100: The Collapse of a Climate Consensus

One hundred weeks ago, this blog was launched with a simple but unfashionable proposition: that responsible investing requires actual responsibility—fact-checking bold claims, scrutinizing moral imperatives, and asking the questions that ESG proponents hoped no one would. The earliest posts warned that financial institutions were embracing climate orthodoxy without verifying its scientific foundations, moral justifications, or economic consequences. The goal was never to parrot "the consensus" or court controversy, but to restore what should have been table stakes in finance: independent judgment grounded in full-context reasoning.

Week after week, the evidence accumulated. But this week—our hundredth—feels less like a checkpoint and more like a verdict.

The body of research featured here does what ESG never attempted: it examines the scientific claims at the heart of Net Zero policy and other aspects of ESG, not through slogans or model outputs, but through empirical tests, methodological critique, and open intellectual debate. The result? A devastatingly consistent pattern: climate risk as framed by IPCC Summaries for Policymakers and so many financial companies is selectively presented, and built on faulty or opaque data. The warming supposedly caused by global decarbonization policies would be barely measurable even in theory—less than 0.1°C by 2050. That estimate alone demolishes the central climate “benefit” ESG investing purports to deliver.

Even more damning is what’s buried or ignored: solar variability, cloud dynamics, ocean cycles, CO₂’s diminishing returns, and the life-sustaining role of hydrocarbons. Peer-reviewed critiques by Dagsvik, Lindzen, Happer, and dozens of others point to a conclusion the ESG world cannot stomach—that modern warming, to the extent it has occurred, is neither catastrophic nor unprecedented, and that fossil fuels remain essential to human flourishing.

In this light, ESG ceases to look like a “framework” or a “lens,” and more like a vehicle for institutionalizing pseudoscience. Worse, it’s used to justify coercive regulations, capital misallocation, and mass energy deprivation—from green bond mandates to stranded assets, from regulatory burdens to the engineered scarcity now affecting Indigenous communities and the global poor.

Abandoning ESG is not radical. It’s rational. Week 100 delivers the clearest case yet that the entire premise—climate risk as material, CO₂ as pollutant, Net Zero as salvation—is not just flawed, but refuted. No investor or policymaker acting in good faith can encounter this body of work and still believe ESG is grounded in objective science or sound ethics.

Let this week mark the end of “assumed climate risk,” and the beginning of actual due diligence.

This week’s post is deliberately about double the size of a normal week’s post and features many proofs of the folly of ESG. Enjoy reading.

CHART OF THE WEEK

SCIENCE

IPCC misrepresentations: comments made by former IPCC contributors after cutting ties with the politicized body — so scientists no longer subject to professional repercussions.

IPCC scientist #25 - Dr Andrew Lacis: “There is no scientific merit to be found in the Executive Summary. The presentation sounds like something put together by Greenpeace activists and their legal department.”

Thank you for the opportunity to comment on the proposed SEC requiring disclosures of climate related risk caused by fossil fuels and CO2.

We are career physicists who have specialized in radiation physics and dynamic heat transfer for decades. In our opinion, science demonstrates that there is no climate related risk caused by fossil fuels and CO2 and no climate emergency.

Further, nowhere in the more than 500 pages of the proposed rule is there any reliable scientific evidence that there exists a climate related risk. None. It refers to the International Panel on Climate Change (“IPCC”), the Task Force on Climate-Related Financial Disclosures (“TCFD”) and other outside groups, but never provides any reliable scientific evidence that supports the rule. The science is just assumed. Therefore, there is no reliable scientific basis for the proposed SEC rule.

Further, contrary to what is commonly reported, CO2 is essential to life on earth. Without CO2, there would be no photosynthesis, and thus no plant food and not enough oxygen to breathe.

Moreover, without fossil fuels there will be no low-cost energy worldwide and less CO2 for photosynthesis making food. Eliminating fossil fuels and reducing CO2 emissions will be disastrous for the poor, people worldwide, future generations and the country.

Finally, the cost of the proposed rule is enormous and would have no public benefit. It would increase the reporting burden to companies $6.4 billion, which is 64% more than the $3.9 billion all SEC reporting requirements have cost companies from its beginning in 1934. Id., 87 Fed. Reg., p. 21461.

Thus, the rule must not be adopted or, if adopted, ruled invalid by the courts.

Here’s the science why.

Our take: the eminent physicists who wrote this have published hundreds of studies in the scientific literature and have studied what is purported to be climate change science for decades. They highlight how the finance world has just assumed there is a climate crisis and climate risks, but say there is absolutely no evidence for these. None. How many finance companies have done even a first-level due diligence on this question? We have a hard time locating them - either they have not done it, or do not speak up, and both are bad for humanity and bad for the investors to whom they have a fiduciary duty.

The Intergovernmental Panel on Climate Change (IPCC) attributes observed climate variability primarily to anthropogenic CO₂ emissions, asserting that these emissions have driven approximately 1 Wm⁻² of net radiative forcing since 1750, resulting in a global temperature rise of 0.8-1.1°C. This conclusion relies heavily on adjusted datasets and outputs from global climate models (GCMs) within the Coupled Model Intercomparison Project (CMIP) framework. However, this study conducts a rigorous evaluation of these assertions by juxtaposing them against unadjusted observational data and synthesizing findings from recent peer-reviewed literature. Our analysis reveals that human CO₂ emissions, constituting a mere 4% of the annual carbon cycle, are dwarfed by natural fluxes, with isotopic signatures and residence time data indicating negligible long-term atmospheric retention. Moreover, individual CMIP3 (2005-2006), CMIP5 (2010-2014), and CMIP6 (2013-2016) model runs consistently fail to replicate observed temperature trajectories and sea ice extent trends, exhibiting correlations (R²) near zero when compared to unadjusted records. A critical flaw emerges in the IPCC’s reliance on a single, low-variability Total Solar Irradiance (TSI) reconstruction, despite the existence of 27 viable alternatives, where higher-variability options align closely with observed warming—itself exaggerated by data adjustments. We conclude that the anthropogenic CO₂-Global Warming hypothesis lacks empirical substantiation, overshadowed by natural drivers such as temperature feedbacks and solar variability, necessitating a fundamental reevaluation of current climate paradigms.

The anthropogenic CO₂-Global Warming hypothesis, as articulated by the Intergovernmental Panel on Climate Change (IPCC) and supported by researchers such as Mann, Schmidt, and Hausfather, lacks robust empirical support when subjected to rigorous scrutiny. This analysis integrates unadjusted observational data and recent peer-reviewed studies to demonstrate that the assertion of human CO₂ emissions as the primary driver of climate variability since 1750 is not substantiated. Instead, natural processes—including temperature feedbacks, solar variability, and oceanic dynamics—provide a more consistent explanation for observed trends. A key finding is the minimal contribution of anthropogenic CO₂ emissions to the global carbon cycle. [emphasis added]

Our take: again, when a hypothesis is based on self-fulfilling models and comes into conflict with empirical observations of reality, which side do you accept as valid - the models or reality?

In March last year, the Securities and Exchange Commission (SEC) issued its climate risk disclosure rule, called “The Enhancement and Standardization of Climate-Related Disclosures for Investors.”

It requires companies to report enormously costly and voluminous data on their carbon dioxide and other greenhouse gas (GHG) emissions. With this rule, the SEC seeks “to achieve the primary benefits of GHG emissions disclosure” for investors, including disclosure of “risks associated” with regulations such as President Biden’s “commitments to reduce economy-wide net greenhouse gas emissions … to reach net zero emissions by 2050.”

It will flood investors with pages upon pages of information. As to costs, the SEC’s own numbers found that the proposed rule would increase annual compliance costs from $3.8 billion to $10.2 billion, a $6.4 billion rise — more than all the accumulated SEC disclosure rules’ costs from SEC’s initiation in the 1930s to date – combined. Even though the final rule’s cost is less, the numbers indicate the order of magnitude. It may signal what the ultimate cost of future environmental disclosures would be, in addition to the ensuing fossil fuel divestment.

The SEC assumes, like many, the Intergovernmental Panel on Climate Change claim the “evidence is clear that carbon dioxide (CO2) is the main driver of climate change,” including, the SEC asserts, “higher temperatures, sea level rise, and drought”, as well as “hurricanes, floods, tornadoes, and wildfires.”

However, the little-known accurate science is totally contrary to the SEC’s and IPCC’s premise. Co-author William Happer, an emeritus physics professor at Princeton, explains below how carbon dioxide and other GHGs do not cause any increased climate related risks. The SEC’s and IPCC’s claim is scientifically false.

Thus, the SEC rule would compel companies to disclose scientifically false and misleading information about carbon dioxide and other GHG’s role in climate-related risks to investors. Accordingly, the SEC rule must be rescinded by the Trump Administration or ruled invalid by the courts, whichever is sooner.

Our take: climate disclosure rules turns investor due diligence into ideological compliance, burdening companies with billions in costs to report speculative risks based on contested science. For Canadian fund managers, this is a cautionary tale of how regulatory overreach can substitute political narratives for material financial analysis. Imagine not only a scenario where “greenwashing” is punished, but companies are forced to publish “greenwashing” lies. Madness.

Recent historically low global tropical cyclone activity

Tropical cyclone accumulated cyclone energy (ACE) has exhibited strikingly large global interannual variability during the past 40-years. In the pentad since 2006, Northern Hemisphere and global tropical cyclone ACE has decreased dramatically to the lowest levels since the late 1970s. Additionally, the global frequency of tropical cyclones has reached a historical low. Here evidence is presented demonstrating that considerable variability in tropical cyclone ACE is associated with the evolution of the character of observed large-scale climate mechanisms including the El Niño Southern Oscillation and Pacific Decadal Oscillation. In contrast to record quiet North Pacific tropical cyclone activity in 2010, the North Atlantic basin remained very active by contributing almost one-third of the overall calendar year global ACE.

Our take: it is well-known in the science literature that cyclone/hurricane frequency and intensity is not increasing, never mind due to human CO2 emissions. Despite this, we constantly hear claims that every storm that makes the news has been made more probable or made worse by human activity. How long will it take until financial companies who keep speaking about worsening storms in their ESG materials will be held to account for making false statements?

The following list of section headers can help navigate among them. (Sorry, the listed entries do not have internal links to the actual sections.)

Changes in the Sun Explain Most of the Heating and Cooling of the past 140 years.

WSJ Reports: Honest Greenhouse-Gas Climatologists Admit Clouds Make Greenhouse-Gas-Based Forecasts Unreliable

Distortions and Restorations of Historical Temperatures

“ClimateGate” and the “Hockey Stick”—Alarmists “Cook” the Books

The Restored Temperature Record of the past 2,000 years Shows Large-Scale Natural Climate Change Up AND Down

The IPCC and Willie Sutton—$$$—More Cooking

Evidence of Natural Climate Cooling

Ice Ages Past and To Come As the Earth’s Orbit and Rotation Oscillate (including Milankovitch Cycles)

Greenland Ice Core Data Show a Cooling Trend Over the Past 2,000 Years

Wikipedia: The Holocene Climatic Optimum Occurred 9,000 to 5,000 Years Ago

The “Water-Vapor Feedback Effect” Deception

Unreliability of Weather and Climate Forecasts

Warmings Unrelated to Runaway CO2 Heating

City heat and “heat island effects” make the Earth look like it is warming much more than it is

Industrial Soot, Polar-route Jet Contrails, and Volcanoes Muddy the Picture Further

Words That Have Been Misused to Mislead

Climate Studies and Computer Programs Employ Facts of Science But Are NOT Science As a Whole

“Greenhouse Gas”

Greens’ War on Fertilizers and Food

Bjorn Lomborg and the Copenhagen Consensus

Our take: this exhaustive post shines in its commitment to full-context reasoning, drawing on overlooked or deliberately avoided scientific data, historical temperature records, and credible dissenting voices to challenge CO₂-centric climate narratives. His emphasis on solar and orbital influences, along with critiques of model unreliability and climate policy consequences, provides a valuable counterbalance to mainstream discourse.

NOAA’s Homogenized Temperature Records: A Statistical House of Cards?

For years, climate scientists have assured us that NOAA’s homogenized temperature datasets—particularly the Global Historical Climatology Network (GHCN)—are the gold standard for tracking global warming. But what if the “corrections” applied to these datasets are introducing more noise than signal? A recent study published in Atmosphere has uncovered shocking inconsistencies in NOAA’s adjustments, raising serious concerns about the reliability of homogenized temperature records.

The study analyzed NOAA’s GHCN dataset over a decade and found that:

The same temperature records were being adjusted differently on different days—sometimes dramatically.

64% of the breakpoints identified by NOAA’s Pairwise Homogenization Algorithm (PHA) were highly inconsistent, appearing in less than 25% of NOAA’s dataset runs.

Only 16% of the adjustments were consistently applied in more than 75% of cases, meaning the majority of “corrections” are shifting unpredictably.

Less than 20% of NOAA’s breakpoints corresponded to actual documented station changes, suggesting that many adjustments were made without supporting metadata.

In layman’s terms: NOAA is repeatedly changing historical temperature records in ways that are inconsistent, poorly documented, and prone to error.

If NOAA’s adjustments are inconsistent, how can we trust the long-term climate trends derived from them? Here’s why this matters:

Garbage In, Garbage Out: Climate models and policy decisions rely on adjusted temperature data. If those adjustments are unreliable, the conclusions based on them are questionable.

Artificial Warming or Cooling? The study did not specifically analyze whether these inconsistencies bias the data towards warming or cooling, but past research has shown that homogenization tends to amplify warming trends.

Lack of Transparency: NOAA’s daily homogenization updates mean that the past is constantly being rewritten, with little accountability or external validation.

Our take: NOAA’s moving-target “homogenization” of temperature records is a textbook case of the scientific method being replaced by opaque algorithmic manipulation, where the signal becomes whatever the modelers wish to find. Adjusting historical data without consistent methodology or ground-truthed metadata isn’t “science,”it’s narrative engineering that undermines any serious claim to objectivity or reliability in climate trend analysis.

How the IPCC Buried the Medieval Warm Period

And why it keeps proving today’s warming isn’t unique or unnatural

Every year, new temperature records are breathlessly announced as though the planet is plunging into uncharted climate chaos. Mainstream headlines proclaim things like "Humanity just lived through the hottest 12 months in at least 125,000 years" or "This year virtually certain' to be warmest in 125,000 years, EU scientists say". We’re told, often without context or qualification, that the warming we’re experiencing is unlike anything seen in hundreds of thousands, or even millions, of years.

But is that really true? Or have climate authorities, especially the Intergovernmental Panel on Climate Change (IPCC), built their entire narrative on the selective memory of Earth’s climate past?

The most insidious and fraudulent aspect of modern climate science isn't flawed models or uncertain predictions... it's the deliberate erasure of past climatic states that undermine the prevailing narrative. The IPCC, ostensibly tasked with objective scientific assessment, has become a vehicle for confirmation bias, selectively omitting historical climate extremes to support alarmist conclusions. I've extensively documented this inherent bias, highlighting how it shapes and distorts their findings (Confirmation Bias within the IPCC).

the Medieval Warm Period (MWP)—a globally recognized warm epoch from roughly 950 to 1250 AD—poses an existential threat to the IPCC-endorsed narrative that modern warming is unprecedented. Initially documented extensively, the MWP was systematically erased from mainstream climate records following the infamous hockey stick graph popularized by Michael Mann in 1999. This graph significantly flattened historical temperature variability to emphasize recent warming, providing political ammunition for urgent climate action despite contradictory historical evidence (The Medieval Warm Period: A Global Phenomenon?).

This erasure isn't accidental. The IPCC's Sixth Assessment Report (AR6) minimizes the MWP, often describing it as a regional or modest climate fluctuation... not a globally significant phase. This vague framing allows them to avoid confronting the wide body of peer-reviewed evidence showing synchronized warming across both hemispheres, a conclusion that undermines the entire premise of modern warming being "unprecedented."

Our take: Wielicki’s article lands a heavy blow on the IPCC’s foundational narrative by resurrecting the Medieval Warm Period (MWP) as a global and, in some regions, more intense warm phase than today—without elevated CO₂. By highlighting peer-reviewed Antarctic evidence of medieval glacier melt absent modern emissions, the piece exposes the IPCC's selective historic framing not just as an oversight, but as an institutional necessity to sustain the "unprecedented warming" storyline. It’s a reminder that erasing inconvenient climate history isn’t science—it’s marketing.

INVESTMENT/ECONOMICS

The OSC says looser regulations in the U.S. could lead to Canadian exodus

The securities regulator has snipped red tape and is considering other measures to boost Canada’s competitiveness and access to capital.

Speaking on stage at the Ontario Securities Commission’s annual symposium in Toronto on Thursday, CEO Grant Vingoe said Canadian capital markets risk facing a “hollowing out.” A looser and more favourable U.S. regulatory environment, including in sectors that the Trump administration has supported, like crypto, could entice Canadian companies to move there.

To combat this, the commission is focused on both short and long-term measures to reduce regulatory burdens. Last week the Canadian Securities Administrators (CSA), said it would waive certain paperwork requirements for companies angling to go public and give firms more flexibility to raise capital.

The CSA paused its work on climate and diversity-related disclosure requirements on Wednesday, citing risks to the country’s competitiveness.

Our take: we wonder why Canadian regulators would not want a more favorable investing environment in the first place, and why it takes the increasing competitiveness in another jurisdiction to motivate the reduction in red tape here in Canada. Why would Canada not want to be the most favourable location for investment and business growth in the world? What ideas have we adopted that go against freedom, innovation, progress, prosperity and the protection of investor and investee rights?d

Banks and business are talking sense on climate at last. But it must not be just talk

The Davos elites must not be permitted to shift from green-washing to ‘green-hushing’

After years of bragging about their climate policies, multinational businesses and international organisations are now going silent about their sustainability goals. They are no longer green-washing but “green-hushing”. Yet, green targets are bad for business and a terrible way to help the world. These actors shouldn’t just be quieter about them. They should stop this waste.

These green pledges were always silly. Humanity has spent trillions on climate policy, but more than four-fifths of global energy is still supplied by fossil fuels. Over the past half-century, fossil fuel energy has more than doubled, with 2023 again setting a new record. Consumers and businesses want more energy. It is a foolish company that declares it will supply less.

Yet, there are worrying signs that many companies are only changing their language, not their actions. A recent global survey of 1,400 corporate executives found that 58 percent of companies “are deliberately planning to decrease their level of external communications” about climate policies, even though most intend to spend even more on climate policies than before. In other words, for many companies greenhushing amounts to going greener, while lying about it by omission. Shareholders need to ask hard questions.

Ridiculously, both the World Bank and the African Development Bank divert much of their climate funds to “mitigation” measures to cut the emissions of poor people, meaning they will have even less opportunity to increase their energy access to drive development. The world’s poorest do not need decarbonisation plans or lectures on their paltry carbon emissions. They need growth plans.

Our take: For Canadian investment managers, this article offers a sobering reminder that sustainability pledges often serve as PR theatre rather than serious investment strategy. The pivot from "greenwashing" to "greenhushing" isn’t a moral evolution—it’s an admission that ESG imperatives can’t withstand economic gravity. The real risk isn’t that firms are backpedaling, but that they ever promised to shrink energy supply in a world that needs much more. Fund managers would do well to ask: were these green goals ever aligned with fiduciary duty, or just an expensive detour from it?

Net Zero Banking Alliance Drops Requirement to Align Financing with 1.5°C

The Net-Zero Banking Alliance, a UN-backed coalition of banks aimed at advancing global Paris Agreement climate goals through their financing activities, announced a series of significant changes to its framework and principles for members, including eliminating a mandatory requirement for banks to align lending and capital markets activities with the goal of limiting global warming to 1.5°C.

The changes follow a rapid-fire series of departures from the alliance over the past few months, which saw all major U.S., Canadian and some other banks leaving the NZBA, as political pressure, particularly in the U.S., has targeted financial institutions participating in climate-focused coalitions.

The NZBA said that its members “voted overwhelmingly” in favour of the changes, which it said will enable the group to increase focus on “unlocking opportunities for financing real economy decarbonization.”

The NZBA noted that the changes were made in response to a “new reality” in which “the external landscape for banks has rapidly changed,” with the organization’s next phase aimed at “supporting member banks to progress against their individual climate-related strategies,” and helping banks to “address constraints on green growth by working with their clients to advance policies that stimulate markets and unlock opportunities for investment.”

Our take: The Net-Zero Banking Alliance’s latest retreat from mandatory 1.5°C financing alignment is a revealing case of ESG ideology colliding with economic and political reality. Stripped of much of its coercive core, the NZBA now postures as “practical,” while still advancing an anti-energy, anti-growth agenda cloaked in euphemisms like “unlocking opportunities.” The underlying goal remains unchanged: to centralize control over capital flows and punish sectors essential to human flourishing. That this shift is framed as progress shows the movement’s Orwellian knack for redefining failure as success—proof that Net Zero is not a science-based goal but a faith-based crusade against freedom and prosperity.

Big Banks Quietly Prepare for Catastrophic Warming

Top Wall Street institutions are preparing for a severe future of global warming that blows past the temperature limits agreed to by more than 190 nations a decade ago, industry documents show.

The big banks' acknowledgment that the world is likely to fail at preventing warming of more than 2 degrees Celsius above preindustrial levels is spelled out in obscure reports for clients, investors and trade association members. Most were published after the reelection of President Donald Trump, who is seeking to repeal federal policies that support clean energy while turbocharging the production of oil, gas and coal — the main sources of global warming.

"We now expect a 3°C world," Morgan Stanley analysts wrote earlier this month, citing "recent setbacks to global decarbonization efforts."

The stunning conclusion indicates that the bank believes the planet is hurtling toward a future in which severe droughts and harvest failures become widespread, sea-level rise is measured in feet rather than inches and tropical regions experience episodes of extreme heat and humidity for weeks at a time that would bring deadly risks to people who work outdoors.

The global Paris Agreement, from which the U.S. is withdrawing under Trump, aims to limit average temperature increases to well below 2 degrees Celsius. Scientists have warned that permanently exceeding 1.5 degrees — a threshold the world breached for the first time last year — could lead to increasingly severe climate impacts, such as the demise of coral reef ecosystems that hundreds of millions of people rely on for food and storm surge protection.

Our take: This article is not science reporting; it's climate theater masquerading as financial foresight. Scientific American here acts more like a political pamphlet than a scientific publication, stitching together disparate reports from banks and trade associations to fabricate a narrative of panicked institutional surrender to climate doom. The article’s primary ESG fallacy lies in equating investor scenario modeling—prudently mapping plausible outcomes including outliers—with ideological endorsement of climate alarmism. That Morgan Stanley analyzes air conditioning stock potential in a 3°C world is not proof of "catastrophic warming" any more than flood insurance pricing predicts Noah’s Ark.

Moreover, the piece smuggles in subjective adjectives (“stunning,” “deadly,” “hurtling”) to imply consensus catastrophe, while the sources it cites are either climate-themed subcommittees within larger institutions or speculative modeling outfits like Climate Action Tracker—none of which speak for "Wall Street" or for science. There is no scrutiny, no questioning of assumptions, no economic or technological counterweights, no scientific method. By pretending that quietly issued stress tests validate activist climate claims, the article commits the classic ESG inversion: mistaking risk aversion and regulatory CYA for scientific endorsement. In reality, it’s not finance bowing to physics, but politics browbeating both.

Major Lenders Withdraw From Green Operations

Major financial institutions, including the World Bank and UK lenders, are softening their climate approaches and withdrawing from some green operations.

Professor Michael Mainelli, former Lord Mayor and chairman of the Z/Yen Group, said: “US influence, demonstrated by the effect on the GFCI 15 from the new administration pulling back from climate commitments shows how shallow green finance waters remain.”

Deutsche Bank’s DWS Fined $27 Million for Greenwashing

In a statement following the announcement, DWS said that it has “acknowledged that in the past our marketing was sometimes exuberant,” and that the firm has already improved its internal documentation and control processes.

The announcement concludes a long-standing greenwashing saga for the asset manager, which began in August 2021, with allegations by DWS’ former sustainability chief Desiree Fixler that the firm misrepresented in its annual report on the extent to which assets were invested using ESG integration in the investment process.

Our take: since the definition of “green” is anti-conceptual, it is very easy to be accused and found guilty of greenwashing. Far better to not be a pretend green at all.

Canada is squandering the greatest oil opportunity on Earth

Canada has 3X US oil reserves but less than 40% the production. Why? Anti-oil politicians like Mark Carney who say they're protecting Earth's coldest country from global warming.

Canada has the greatest oil opportunity on Earth: > 3 times the reserves of the US, with lower production costs

Canada has 170 billion barrels of proven oil reserves—by far the largest of any free country. And its producers can profit at $44 oil, vs. >$57 for US shale.

Canadian oil production is also continuing to get cheaper. Oil sands operating costs have dropped 19% over the past five years, and the industry—which is still fine-tuning how to coax oil-like bitumen out of oil sands—has substantial room for further cost reductions.

In addition to its massive proven oil reserves, Canada also has massive unexplored oil resources. Canada’s Northwest Territories may contain up to 37% of Canada’s total oil reserves, much of it light crude, which is even cheaper to extract and transport than bitumen from oil sands.

In 2023, oil sands directly contributed C$38 billion to GDP—while total economic impact was 100s of billions of dollars. It could have been far, far greater.

Canada’s oil underproduction is undermining both Canadian prosperity and global security. E.g., Europe’s dependence on Russian oil triggered an energy crisis after Russia invaded Ukraine. By doubling its oil production, Canada could make oil dictators weaker, the free world stronger—and Canada more powerful.

Canada is safer than ever from climate, and other countries won’t cut emissions until it’s truly cost-effective to do so. The path forward is to embrace prosperity.

The more prosperous Canada is, the more it can make itself more and more resilient to all manner of climate dangers. And the more prosperous Canada is, the more it can innovate new forms of energy that have the long-term prospect of outcompeting fossil fuels.

Our take: if you have ever seen a clearer and more compelling vision of how Canada can prosper and help the world prosper by unshackling energy producers, let us know.

Report finds ‘Heat Poverty’ crisis deepens on reserves as Ottawa pursues emissions cuts

As the federal government in Ottawa pushes ahead with its climate agenda — including caps on fossil fuel emissions — many First Nations communities across Canada are warning that they’re being left out in the cold.

Literally.

That’s because a new report by Energy for a Secure Future (ESF) highlights a deepening crisis of energy poverty on First Nations reserves, where the lack of access to affordable heating options, especially natural gas, is forcing families to choose between food and warmth.

“We’ve been calling it heat poverty because that’s what it really is,” said Chief Christine Longjohn of the Sturgeon Lake First Nation. “Our families are finding that they have to either choose between buying groceries or heating their home.”

Key Facts:

• 333 First Nations communities are not connected to natural gas utilities.

• Over 280 remote communities, home to 200,000 people, rely primarily on diesel and propane.

• On-reserve households spend 3x more of their income on energy than average Canadian households.

• Natural gas access could cut heating costs by 50-70%, based on case studies in Ontario and Alberta.

Despite natural gas being Canada’s most affordable and widely used heating fuel — used in more than half of all Canadian households — at least 333 First Nations remain disconnected from natural gas infrastructure, according to the Canada Energy Regulator (CER).

The irony is that many of those communities are located just a few kilometres from existing pipelines.

In Saskatchewan, 20 First Nations passed a resolution last year urging the federal government to enhance financial support for natural gas access as a “more desirable” path toward energy security.

But progress has been slow as Ottawa, counterintuitively, takes steps to reduce natural gas use across the country.

Our take: In classic fashion, Ottawa’s climate crusade manages to be both expensive and inhumane—cutting off Indigenous communities from affordable natural gas while preaching sustainability from heated offices. The moral cost of denying people heat in the name of emissions virtue-signaling should be indefensible. As Alex Epstein often points out, energy poverty isn't a bug of anti-fossil policies—it’s the feature.

Dirty power: The hidden climate cost of electric vehicles

Headlines celebrate electric vehicles as a solution for climate change. But are they? A recent study raises new doubts.

Researchers from the University of Auckland and Xiamen University argue that electric vehicles cannot help the planet unless we clean up the electricity that powers them.

The researchers looked beyond surface-level calculations. They tested how electric vehicle adoption, renewable energy use, population clustering, and green innovation all shape a country’s carbon output.

The results do not align with the common belief that more electric vehicles mean fewer emissions.

“On the contrary, EV adoption is positively associated with CO₂ emissions. This finding appears counterintuitive. It challenges the conventional belief that EVs contribute to decarbonization,” said study lead author Miaomiao (Simon) Tao, a doctoral candidate at the UoA Energy Centre.

Our take: Once again, the climate narrative collapses under scrutiny: EVs aren’t clean if the grid isn’t. This obsession with “clean cars” ignores the dirty reality of where power comes from—and who pays the price when policy skips over that fact. Until the grid is powered by nuclear and/or hydro, mandating EVs just means outsourcing emissions from the tailpipe to the smokestack.

A responsible investing ‘service gap’ persists: report

Canadian retail investors remain keen on responsible investments (RI), but financial advisors are still not rising to the moment to address client interest, according to a report from the Responsible Investment Association (RIA) released Thursday.

RIA’s ninth annual Investor Opinion Survey, conducted between late January and early February, revealed that while 76% of respondents wanted their financial advisor or institution to be required to ask them specific questions about RI considerations as part of the know-your-client or client review process, only 28% said their financial services provider asked such questions.

These findings show that an “RI service gap” has “not only persisted, but expanded from last year,” when 35% of investors said their financial services provider asked such questions, said Glen Pichanick, head of advocacy and industry insights with RIA.

Catherine Philogène, vice president, product management and ESG funds with RBC Global Asset Management, said there might be “a bit of a reluctance for advisors” to bring up the topic of RI.

She also suggested that greenwashing concerns could have had “a bit of a chilling effect,” leaving advisors waiting for clearer guidance around RI and ESG. More than half (54%) of survey respondents said greenwashing was a deterrent to investing in RI funds for them. That’s up from the 46% reported in 2023.

Our take: As ESG’s contradictions become harder to ignore, the so-called “RI service gap” might be less a matter of advisor ignorance and more a quiet retreat from a narrative that’s starting to fray. Advisors may sense what Alex Epstein has long argued—that ESG investing often sacrifices real human flourishing for vague moral signaling. As the costs and failures mount, silence may be the first step toward quietly backing away.

Octopus Supports Tortoise to Promote Net Zero Sceptics

"Misinformation" database turns into showcase for Net Zero scepticism

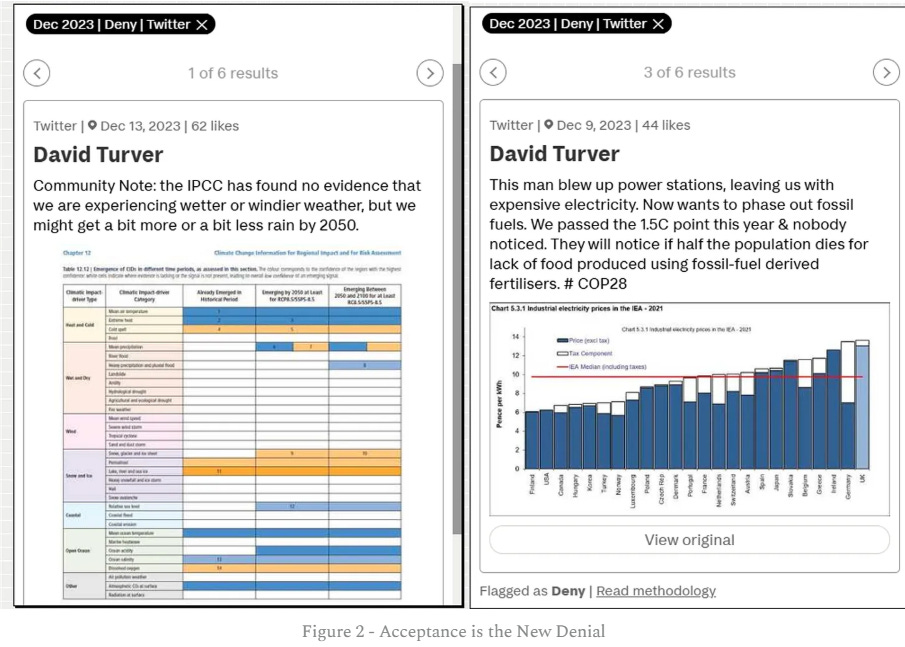

Tortoise’s Hot Air database gets even more interesting when you dig into what they classify as denial (see Figure 2).

Apparently quoting a table taken directly from the latest IPCC report that shows very little evidence for more extreme weather out to 2100, even using RCP8.5 which is the most extreme modelling scenario, amounts to denial. Even acknowledging that warming since 1850 passed the supposed limit of 1.5oC amounts to denial in the eyes of their AI models.

Our take: when you set out to shame Net Zero dissenters and accidentally hand them a curated highlight reel! When your “misinformation” list includes government data, physics, and basic economics, it’s less about truth and more about silencing the wrong kind of thinking.

California proposes break to rooftop solar contracts, raising average bills $63

Over one million California homes that invested in rooftop solar may have their net metering contracts rescinded under the proposed bill AB 942.

A new proposal in the California legislature, AB 942, seeks to break nearly two million rooftop solar net metering contracts and shift existing customers onto a rate structure that would decrease credits on their electricity bills by roughly 80%. If passed, the proposal would increase a typical solar customer’s bill by $63 per month.

Over two million rooftop solar projects are installed in California on homes, schools, small businesses, and other rate paying customer sites. Californians invested tens of thousands of dollars or entered 20+ year contracts with the expectation that they would secure predictable, stable electricity rates for the next two decades or more.

This predictable cost for electricity amid steadily increasing utility-provided electricity rates was made possible by net energy metering (NEM), which enables customers to export excess daytime production to the local grid in exchange for credit on their electricity bills.

According to the California Public Utilities Commission (CPUC), the state’s three largest electric utilities PG&E, SCE and SDGE have raised customer rates by 110%, 90% and 82%, respectively, over the last decade. Despite relatively flat electricity usage, transmission and distribution spending by utilities has increased 300%.

Our take: California’s rooftop solar debacle is a textbook case of ignoring full-system costs in favor of ideological optics and misleading metrics like LCOE. For years, critics warned that subsidizing intermittent, decentralized solar without accounting for the massive cost of grid backup, storage, and infrastructure would ultimately punish ratepayers. Now, AB 942 proposes retroactively breaking net metering contracts—betraying over a million families who made long-term investments based on the state’s own promises. The bait-and-switch reveals the fragility of climate policy untethered from economic and technical reality: when fantasy collides with grid economics, it's always human freedom and affordability that take the hit.

Europe’s Energy Transition Stutters, Again

A cold and low-wind winter in Europe exposed the seasonal limitations of wind and solar.

As spring and summer bring a surge in solar output, Europe faces grid management challenges and a rise in negative electricity prices.

Despite past progress, Europe’s energy transition is facing setbacks—highlighting the difficulties of relying heavily on intermittent renewables without robust backup systems.

Europe has been at the forefront of global efforts at an energy transition as it prioritized the reduction in carbon dioxide emissions over any other policy priorities. It has had some marked success, too—the EU, which covers most of Europe, saw its emissions dip by 2.9% last year. This year, however, the trend has reversed. Emissions are up. And there’s transition trouble on the way.

The winter months in Europe are notable with respect to transition efforts because they represent the trough season for both wind and solar, especially solar. There isn’t much sunshine between November and March, so the conversion factor of solar installations drops sharply during that season. Wind droughts are a less “obligatory” part of the winter season, but they do tend to happen during the colder months—and Europe sure got some wind droughts at the end of 2024. This boosted gas demand led to a faster depletion of gas inventories and sparked fears of whether there would be enough gas to last until spring.

“One of the great engineering challenges of decarbonisation is managing our system when there is lower demand coinciding with higher levels of generation from renewable sources,” the head of resilience and emergency management at the National Energy System Operator said, as quoted by Bloomberg. The other challenge is negative electricity prices because of the excessive output. Europe has seen a substantial increase in the incidence of negative electricity prices with the surge in wind and solar deployment, and it is going to see further increases as well as the buildout continues.

This will hurt non-intermittent generators, as it has already hurt nuclear generators in France, per a recent Bloomberg report. As wind and solar power take priority over all other forms of energy generation, those other generators need to adjust their output based on wind and solar output—and that costs money. Emissions, meanwhile, will continue to follow overall energy demand and supply patterns, oblivious to transition efforts in Europe or anywhere else.

Our take: this piece deserves credit for candidly acknowledging what energy realists have long warned: seasonal intermittency and lack of dispatchable backup make Europe’s renewables-centric transition technically fragile and economically reckless. The winter shortfall exposed how wind and solar collapse when needed most, while the looming spring glut highlights the grid instability and price distortions caused by oversupply. The article rightly notes the irony that fossil fuels still save the day—despite being politically maligned—while negative pricing penalizes reliable baseload like nuclear. Europe’s energy strategy is finally confronting physical reality, and this sober recognition is a welcome (potential and reluctant) first step toward restoring sanity to energy policy.

How the Green Energy Transition Makes You Poorer - Crony capitalism at work

A leaked government analysis has found that Net Zero could crash the economy, reducing GDP by a massive 10% by 2030. Yet the spectacular thing about this analysis is that it expects this to happen not if Net Zero fails—but if it succeeds. In effect, it is saying that if the government really does force us to give up petrol cars, gas boilers, foreign holidays, and beef, then there would be perfectly workable things left idle, such as cars, boilers, planes, and cows. Idling—or stranding—your assets in this way is an expensive economic disaster.

Even more intriguing was the government’s economically illiterate response to the leak. A spokesman said: “Net zero is the economic opportunity of the twenty-first century, and will deliver good jobs, economic growth and energy security as part of our Plan for Change.” Do they really think that economic growth is the same thing as spending money? Because it isn’t.

Imagine the government saying that it is going to require the entire population to throw out all their socks and buy new ones by next Thursday. Under the logic it espouses for Net Zero, this would result in a tremendous burst of economic growth. Think of all the jobs created in the sock industry and the shops! They would be better off. Ah, but you, the consumer, would be poorer. You would have as many socks as before but less money. This is the broken window fallacy, explained by Frédéric Bastiat nearly 200 years ago: going around breaking windows makes work for glaziers but does not create growth.

Net Zero is a project to replace an existing set of technologies with another set of technologies: power stations with wind farms, petrol cars with electric cars, gas boilers with heat pumps, plane trips in the sun with caravan trips in the rain, cows with lentils. The output from these technologies is intended to be the same: electricity, transport, holidays, food.

Our take: The Rational Optimist identifies the economic wishful thinking masquerading as climate policy. His critique skewers the absurdity of “growth by destruction” logic—the very premise that underpins Net Zero mandates. The analogy of sock-replacement economics is not only apt but damning: it reveals the fundamental flaw in the assumption that forced replacement of functioning assets (cars, boilers, cows) constitutes progress.

Ridley rightly calls out the misdirection of state power from consumers to crony beneficiaries, where subsidies funnel wealth from the many to the well-connected few. This isn’t just inefficient—it’s immoral. The Net Zero agenda is detached from the real energy needs of billions of people, and as Lindzen, Happer, and van Wijngaarden calculate, the supposed climatic benefit is negligible—0.07°C by 2050 if the whole world complies.

This is not a green revolution; it’s a green illusion, one that costs the poor while enriching a class of parasitic intermediaries. Ridley, as usual, cuts through the noise with clarity and justified indignation.

Bjorn Lomborg: Net zero’s cost-benefit ratio is crazy high

In 2021, Canada committed itself legally to achieving “net-zero” carbon emissions by 2050. At various times, prime minister Justin Trudeau promised climate action would “create jobs and economic growth,” as well as a “strong economy.” The truth is that net-zero policies generate vast costs for very little benefit — and Canada would be better off changing direction.

Achieving net-zero carbon emissions is far more daunting than politicians admit. Canada is nowhere near on track. Annual Canadian CO₂ emissions have increased 20 per cent since 1990. While Trudeau was prime minister, fossil fuel energy supply actually increased by more than 11 per cent. Similarly, the share of fossil fuels in Canada’s total energy supply (not just electricity) increased from 75 per cent in 2015 to 77 per cent in 2023.

Economist Ross McKitrick recently estimated that the government’s current plan, which won’t even reach net zero, will cost a quarter million jobs and reduce GDP by seven per cent and wages by $8,000 on average.

The best academic estimates show that over the century policies to achieve net zero would cost everyone on the planet the equivalent of more than $4,000 every year. Because most people in poor countries cannot afford anywhere near this, if the cost falls solely on the rich world, the price tag is almost $30,000 per person per year. That’s $120,000 per proverbial family of four. Every year for the rest of this century, global costs would exceed benefits by over $32 trillion each year.

ABSURDITIES

Net zero ‘is destroying the Church of England’

Commitment to cut carbon emissions leaves rural churches out in the cold, Telegraph investigation finds

Canada will no longer cover travel costs of experts it nominates to UN's climate science body

In a sudden and unexplained change from previous decades, the federal government has stopped covering the travel costs of Canadian experts volunteering for the next major global climate science assessment.

The decision to end travel funding means that Canadian scientists are now wondering whether they can still participate in the United Nations climate science process, perhaps by using their own money or diverting grant funds that could be going toward research and students.

In a statement to CBC, Environment and Climate Change Canada said it is "not able to commit to providing long-term travel funding for academics to participate in IPCC meetings."

In its statement to CBC, ECCC said that the government provided about $424,000 of travel funding to support Canadian IPCC authors in the last assessment cycle, which happened partly during the pandemic years and involved a little less travel as a result.

The department said that if the usual amount of travel had occurred, estimated costs would be about $680,000 to support Canadian experts at the IPCC.

Your Tax Dollars At Waste: Kansas School District Halts EV Buses Due to Student Safety Concerns

“Out of an abundance of caution, and in line with our highest priority of student safety, we made the decision to remove the buses from active service while we work with the manufacturer toward resolution.”

So says Wabaunsee USD 329 Superintendent Dr. Troy Pitsch in a Jan. 3, 2025 press release announcing his decision to remove a pair of pricey electric school buses from service. Local TV station KSNT reports that the district took that action due to repeated dangerous operational issues with the buses, including brake failure, steering loss, and other safety-related problems.