Examining ESG #102 - Models, Myths, and Manufactured Crises

From a chart exposing how current CO₂ levels correlate poorly with past interglacial warmth, to evidence-based critiques of the National Climate Assessment’s modeling tricks, the gap between observation and orthodoxy widens. Whether it’s Ottawa’s greenwashing legislation chilling corporate speech, a billion-dollar battery fantasy failing to power reality, or central banks peddling speculative scenarios under scientific pretenses, the theme remains consistent: ideology driving policy, unmoored from empirical grounding or human needs. Meanwhile, activists and bureaucrats persist in recasting tradeoffs as moral absolutes, even as the grid strains and banks retreat from their own green pledges. In this edition, energy realism pushes back against energy theater — and not a moment too soon.

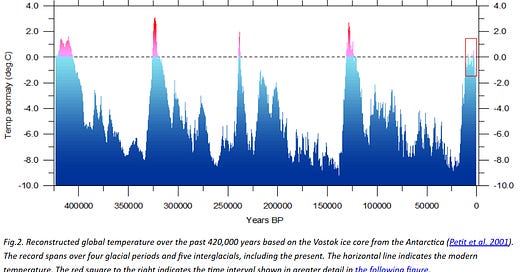

CHART OF THE WEEK

The diagram above (Fig.2) shows a reconstruction of global temperature based on ice core analysis from the Antarctica. The present interglacial period (the Holocene) is seen to the right (red square). The preceding four interglacials are seen at about 125,000, 280,000, 325,000 and 415,000 years before now, with much longer glacial periods in between. All four previous interglacials are seen to be warmer (1-3oC) than the present. The typical length of a glacial period is about 100,000 years, while an interglacial period typical lasts for about 10-15,000 years. The present interglacial period has now lasted about 11,600 years.

According to ice core analysis, the atmospheric CO2 concentrations during all four prior interglacials never rose above approximately 290 ppm; whereas the atmospheric CO2 concentration today stands above 400 ppm (by volume or molecular fraction, as of 2018). The present interglacial is about 2oC colder than the previous interglacial, even though the atmospheric CO2 concentration now is about 100 ppm higher.

SCIENCE

IPCC misrepresentations: comments made by former IPCC contributors after cutting ties with the politicized body — so scientists no longer subject to professional repercussions.

IPCC scientist #27 - Dr Richard Lindzen: “The IPCC process is driven by politics rather than science. It uses summaries to misrepresent what scientists say and exploits public ignorance.”

The National Climate Assessment: Science or Sales Pitch? Exposing the Deep Conflicts Behind America’s Most Influential Climate Report

Every four to five years, the United States government releases the National Climate Assessment (NCA), a sweeping report intended to summarize the impacts of climate change on the U.S. economy, health, infrastructure, and environment. The latest version, the Fifth National Climate Assessment (NCA5), dropped in late 2023 with a flood of media fanfare and dire predictions, many of which you’ve already seen amplified across major outlets.

But few people ever ask: Who actually writes these reports? Who funds them? And who stands to gain if their dire projections come true, or are at least believed to be true?

The USGCRP was established in 1990 to coordinate climate change research, but in recent years it’s become increasingly entangled with activist-driven agendas and ideologically motivated forecasting. The authors of the NCA are overwhelmingly drawn from universities, NGOs, and federally funded labs… institutions that, unsurprisingly, rely heavily on climate-related grant money and policy alignment. That’s where the conflict begins.

When I reviewed NCA5 shortly after its release, I focused on a single contradiction in the report… one that I believe exemplifies its fundamental flaws. In Figure 2.7, the report shows a clear, documented decline in the number of days above 95°F across most of the United States between 2009 and 2021.

That’s actual observational data. Then, just a few pages later, in Figure 2.11, it projects a substantial increase in days over 95°F in the decades to come.

That’s not nuance. That’s narrative. And the models behind those projections, many of which have already been shown to overstate warming, are treated with more authority than actual observations.

Previous National Climate Assessments are littered with failed predictions that went unacknowledged in subsequent reports.

1. NCA1 (2000) projected significant increases in U.S. heatwave frequency by 2020. Yet data from NOAA shows that heatwave frequency and severity have remained relatively stable in many regions.

2. NCA2 (2009) warned of dramatically declining crop yields by 2020 due to climate stress. Actual yields for corn, soybeans, and wheat in the U.S. have reached record highs multiple times in the past decade.

3. NCA3 (2014) emphasized that hurricanes would become stronger and more frequent. But even the IPCC now acknowledges that no long-term trend in global hurricane frequency has been established.

4. NCA4 (2018) used RCP8.5 as its core scenario, a scenario now widely discredited as implausible by climate scientists and economists alike.

Despite these errors, each new NCA leans further into worst-case assumptions, produces more aggressive forecasts, and attracts even more grant funding.So when we ask whether the NCA is a neutral scientific assessment or a self-reinforcing political tool, the answer becomes clear. It is not merely biased… it is structurally designed to maintain funding streams, promote certain political agendas, and marginalize dissenting scientific views.

These are not honest mistakes. They're features of a publicly funded bureaucracy that no longer serves scientific inquiry but rather sustains a self-reinforcing climate-industrial complex.

I love busting myths and the myth that I wish to bust today is the claim that anthropogenic climate change (ACC) brings floods in some areas and droughts in others.

The problem with this claim is that is it assumes climate change is the same thing as ACC.

In closing, while the mechanism associated with the migration patterns of the Hadley Cells, operating on both an annual (Seasonal Cycle) and millennial (Milankovitch) basis, is widely excepted to be due to Orbital Dynamics, the origin of the forcing associated with the 60 year cycle is widely debated.

You can soon expect a dedicated article on the 60 year cycle, where I will argue that the forcing may very well be the shifting solar system center of mass or barycenter.

The hypothesis presented will be that the 60 year cycle is caused by shifting gravitational tidal forces of the Gas Giants, acting on the Sun’s magnetosphere, which acts as a massive geomagnetic shield against ionizing radiation from deep space.

Ultimately, I argue that claiming ACC is responsible for longer term changes in drought and intense rainfall, is akin to claiming that burning natural gas to keep warm in the winter season, is responsible for the arrival of spring and that the arrival of spring is proof of the hypothesis.

New report shows vast majority of Alberta’s oil sands remain ecologically intact

Despite long-standing international perceptions of Alberta’s oil sands as a sprawling industrial wasteland visible from space, new research reveals the vast majority of the region remains in good health — ecologically speaking.

According to a new report from the Alberta Biodiversity Monitoring Institute (ABMI), just 2.6% of Alberta’s oil sands region was directly affected by energy development as of 2021 even though the oil sands cover about 142,000 square kilometres of boreal forest — an area nearly the size of Montana.

“There’s a mistaken perception that the oil sands region is one big strip mine, and that’s simply not the case,” said David Roberts, director of the ABMI’s science centre told the Canadian Energy Centre. “The energy footprint is tiny in the total area once you zoom out to the boreal forest surrounding this development.”

Our take: This data-driven assessment underscores the importance of empirical evidence in environmental discourse. It highlights that responsible resource development and ecological preservation can coexist, prompting a reevaluation of claims and assumptions about industrial impacts on natural landscapes.

INVESTMENT/ECONOMICS

The Canadian Taxonomy: A Centralized Assault on Human Flourishing and Freedom

When a government announces something that supposedly means progress, you can usually be sure the impact will be the exact opposite. This is because government means force, and in economics it means force used to override and distort the choices people would choose if left free of coercion.

A recent case is Finance Canada announcing “Government advances Made-in-Canada sustainable investment guidelines to accelerate progress to net-zero emissions by 2050.”

Our take: A taxonomy is a classification system designed to dictate which activities are deemed “environmentally sustainable.” The Canadian government’s introduction of a Sustainable Finance Taxonomy, as outlined in its October 2024 announcement, is a deliberate move to centralize economic decision-making under the guise of environmental stewardship. This taxonomy aims to classify investments as “green” or “transition” based on criteria aligned with the Net Zero by 2050 objective, thereby directing capital flows according to government-defined sustainability standards.

While presented as a voluntary framework, the taxonomy’s integration into broader regulatory measures, such as mandatory climate-related financial disclosures for large private corporations, reveals its coercive nature. By establishing what qualifies as a sustainable investment, the government effectively marginalizes industries and activities that do not conform to its climate agenda, regardless of their actual contributions to economic prosperity or environmental improvement.

This approach disregards the complex realities of energy production and consumption. For instance, the taxonomy’s criteria may exclude certain natural gas projects from being labeled as “transition” activities, despite their potential role in reducing emissions and providing reliable energy. Such exclusions are based not on comprehensive assessments of environmental impact but on rigid adherence to predetermined emission reduction pathways.

Moreover, the taxonomy’s reliance on “scientifically determined eligibility criteria” fails to acknowledge the ongoing debates and uncertainties within climate science. By treating specific climate models and projections as infallible, the government enforces a singular perspective, stifling alternative viewpoints and critical discourse.

The implementation of this taxonomy exemplifies a broader trend of using environmental concerns to justify increased governmental control over economic activities. By dictating investment classifications, the government not only influences financial markets but also encroaches upon individual and corporate autonomy. This centralization of authority undermines the principles of a free market economy and poses significant risks to innovation, efficiency, and human flourishing.

The Canadian Sustainable Finance Taxonomy represents a shift towards centralized economic planning under the pretext of environmental responsibility. Its adoption threatens economic freedom, suppresses diverse perspectives, and hinders the dynamic processes that drive progress and prosperity.

The Only Thing We Have to Fear (About Climate Change) is Fear Itself

Assuming it is even possible, achieving “‘net zero” would further increase costs because some scheme to power civilization is needed to compensate for the intermittency of wind and solar. Consider the cost of currently favored huge battery banks, which can provide power for, let’s say 10 days.

U.S. power demand is about 400 million kilowatts. Hence, battery banks, located around the country, would have to last for about 10 days, or approximately 250 hours to provide the necessary 100 billion kWh of energy.

Tesla batteries have between 50 and 100 kWh of storage and cost $5,000-$20,000. Assuming conservatively a cost of $10,000 for every 100 kWh of energy, the country would have to spend $10 trillion on 1 billion batteries. Not only that, but battery life is only about 10 years, making annual replacement cost $1 trillion.

Such wasteful expenditures destroy civilizations.

Our take: this article highlights the role of fear in shaping policy and public perception, arguing that while climate change is real, the apocalyptic framing lacks empirical grounding and has lead to policies that hinder human flourishing. By emphasizing the benefits of carbon dioxide and questioning the reliability of climate models, the article calls for a more balanced and evidence-based approach to policy.

On renewables and the unspoken risk of total grid failure.

Today’s Western economies have come to depend on uninterrupted access to electricity so thoroughly that the prospect of losing power for just a few days would be catastrophic, especially in crowded urban areas. In such cities, a prolonged loss of electricity for weeks or more would rapidly break social order, and one shudders to ponder the carnage that would swiftly follow.

The progressive environmental left’s attempts to completely overhaul the production of electricity have similarly necessitated an aggressive public relations campaign, and the success of its shrewdness has been staggering. When it comes to renewable energy sources such as wind and solar, benefits are exclusively covered and grossly overstated, while challenges are hidden by a powerful cloak of propaganda. “Green, clean, and cheap” are repeated ad nauseam throughout our educational, informational, and cultural outlets regardless of the underlying truth of the matter.

The potentially disastrous consequences of these mass manipulation efforts are beginning to materialize. Beyond the well-known issues of intermittency and cost inflation, the proliferation of wind and solar is metastasizing a serious and rarely discussed risk that will eventually be borne by all: The presence of renewables makes our grids far less resilient and far more susceptible to wide-scale blackouts. The trillions of dollars of public money already thrown at this effort provide no protection.

As the penetration of renewable energy grows around the world, grid operators are wringing their hands over the prospect of uncontrolled power losses leading to truly catastrophic events. Although you won’t read about them often in traditional media outlets, numerous similar events across the US have been cataloged by The North American Electric Reliability Corporation (NERC), and the organization has flagged concern over potential extended periods of total power loss at the grid level.

Luckily, inherent in the design of traditional power plants is a feature that delivers substantial redundancy in the face of small disturbances. Thermal generation—using fuel sources like coal, natural gas, or uranium—involves spinning large generators, which creates inertia. The resulting tendency towards continued rotation allows such facilities to ride out short bursts of voltage or frequency variability in the transmission lines. This bend-but-don’t-break feature is often the first line of defense against instabilities. A grid with a substantial amount of inertia is said to be robust, whereas a lack of system-wide inertia is a quivering weakness.

Our take: and right on cue, soon after this article was published, Spain, Portugal and France experienced a day-long blackout that appears to have been caused by a lack of inertia. Lots more will be written about this blackout, and more jurisdictions that are solar-heavy are going to learn about grid inertia.

RBC drops sustainable finance targets, blaming anti-greenwash law

Royal Bank of Canada has dropped its sustainable finance targets – including a $500-billion commitment to decarbonization efforts – blaming the country’s anti-greenwashing provisions and changing measurement practices.

Canada’s biggest bank said on Tuesday that amendments to the Competition Act, enacted by the federal government last year to guard against corporate greenwashing, contributed to its decision to suspend disclosures.

Those provisions within Bill C-59 call for climate reporting to be backed by internationally recognized measures, and put companies at risk of penalty for making false assertions.

RBC also reviewed its methods for measuring and reporting on funds directed at climate and other green initiatives and “concluded that it may not have appropriately measured certain of our sustainable finance activities as presented on a cumulative basis,“ the bank said in its 2024 sustainability report.

“In light of these developments, we will no longer be using this methodology going forward, and we are also retiring our sustainable finance commitment,” the bank said in the report. “Finally, we are considering potential changes to our overall approach to sustainable finance, including our Sustainable Finance Framework.”

Our take: RBC’s retreat from its “sustainable finance” targets under threat of anti-greenwashing laws is the perfect irony of the climate policy industrial complex. First came the climate propaganda: vague, sweeping claims of existential doom requiring trillions in “green” finance. Then came the laws, crafted to codify the propaganda and silence dissent by making any deviation or imprecision punishable. Now, when confronted with having to actually defend the claims in the cold light of regulatory scrutiny, RBC opts out entirely. This cycle - manufacture panic, legislate compliance, then outlaw debate, exposes the ultimate goal: to control speech and action under the guise of planetary salvation.

Is Ottawa’s anti-greenwashing law helping or hurting Canadian companies?

Federal legislation aimed at combatting greenwashing has prompted companies to delete all kinds of public messaging, raising questions about whether the new rules are doing what they were intended to do or actually hindering environmental progress.

Last week, Royal Bank of Canada dropped its sustainable finance targets, including its goal of directing $500-billion to decarbonization efforts and a range of other environmental and social initiatives, citing the legislation, Bill C-59, as one reason for the move.

Supporters of the legislation say corporate decisions to expunge some materials show it is working. Some business groups, notably those tied to natural resource sector, criticize it as overreach.

Two organizations, Alberta Enterprise Group and British Columbia’s Independent Contractors and Businesses Association, launched a constitutional challenge of the new rules, claiming they infringe on corporations’ freedom of speech by quashing debate on environmental issues.

Deciding which standards are valid is a top concern, though the Competition Bureau, which is charged with enforcing the legislation, said it will recognize methodologies deemed credible in two or more countries that result in “adequate and proper substantiation.” It has not offered specific examples, however.

The Competition Bureau said it is focused on marketing and promotional claims, not materials aimed at investors. “However, if the information in those materials is then used by a business in promotional materials, the bureau would consider them as marketing claims,” bureau spokesperson Anna Maiorino said in an e-mail.

Our take: Ottawa’s anti-greenwashing law, under the guise of promoting transparency, is a tool that stifles corporate speech and undermines rational discourse. By mandating that companies substantiate environmental claims using "internationally recognized methodologies," the law imposes vague and burdensome requirements that many businesses find nearly impossible to navigate. This has led to a chilling effect, where companies, fearing legal repercussions, are retracting even well-intentioned environmental commitments from public view.

The irrationality of this legislation lies in its assumption that complex environmental initiatives can be neatly quantified and validated. In reality, environmental progress often involves nuanced, long-term strategies that don't lend themselves to simplistic metrics. By enforcing rigid standards, the law discourages companies from pursuing innovative environmental solutions, lest they run afoul of ill-defined regulations.

Moreover, this approach suppresses open dialogue about environmental practices, replacing it with a climate of fear and silence. Instead of fostering genuine sustainability efforts, the law incentivizes companies to avoid public discussion altogether, hindering the very progress it purports to encourage.

In essence, Ottawa's anti-greenwashing law exemplifies how overzealous regulation, rooted in ideological fervor rather than practical understanding, can backfire, stifling speech, deterring innovation, and ultimately harming the societal goals it supposedly aims to achieve.

The risk of electrifying everything

Unfortunately, green activists, who hardly see any problem with electrifying everything, believe any concerns represent little more than attempts to delay a needed transition away from fossil fuels. Climate deniers only see trouble in green tech, forgetting the risks fossil fuels bring along. In between both positions lays the reality.

The first risk of electrifying everything is meeting the huge extra demand for electrons. Sadly, China is still relying on coal-fired stations to meet the growth in electricity demand. That's a huge risk for the environment.

The second risk is matching a demand that requires 24/7 supply with a generation system that, at the margin, depends today on whether the sun is shining and the wind is blowing. It's unclear how the grid will work when the weather isn't helping. Meanwhile, under pressure to meet green targets, utilities are shutting down dispatchable power plants, like atomic reactors and coal- and gas-fired plants.

The third risk is the grid that connects hundreds of power plants, substations, and consumers. Bottlenecks mean renewables often must wait months, if not years, to start producing. The NIMBY attitude means investments needed to accommodate renewable production are delayed. Spending on the last few miles of connection is sorely missing. The world badly needs many more transformers and low-tension distribution lines.

The fourth risk is the special nature of electricity. Supply and demand of electrons must match every second, every minute, every hour, every day. The coal, gas, and oil markets have many buffers and stockpiles, smoothing out glitches. Electricity doesn't have that luxury. That makes the system more vulnerable.

The fifth risk is price volatility. Compared to fossil fuels, electricity prices have swung incredibly over the last five years. The extreme volatility means not only pain for consumers, but difficult investment decisions by producers. Renewable energy and the need for costly gas-fired power plants as backup are the main reason behind that volatility.

Our take: Sheridan again does a great service by highlighting the risks of electrification that the climalarmist movement does not want us knowing or talking about.

NGFS Releases its First Short Term Climate Scenario

The Network of Central Banks and Supervisors for Greening the Financial System (NGFS), announced today the launch of its first set of short-term scenarios, aimed at enabling central banks and financial sector supervisors to analyze the near-term impact of climate change and climate-related policies on the stability and resilience of economies and financial systems.

The NGFS was established in 2017, with the purpose of helping to strengthen the global response required to meet the goals of the Paris agreement and to enhance the role of the financial system to manage risks and to mobilize capital for green and low-carbon investments in the broader context of environmentally sustainable development.

The organization provides science-based insights aimed at helping financial systems to navigate climate and nature-related risks. The NGFS’s key tools include its long-term climate scenarios – reflecting possible future climate policies, and assessing physical risks, including heat, drought and floods, and short and long-term risks stemming from the transition to a greener economy such as increasing carbon prices – which are used by many central banks worldwide in climate stress tests for banking and financial systems.

According to the NGFS, the new short-term scenarios focus on a five- year time horizon, and offer detailed sector analysis and extensive coverage of financial risk and macroeconomic variables, exploring the interaction of factors including climate policies, extreme weather, economic trends and sectoral shifts.

Among the key feature of the new scenarios highlighted by the NGFS include the accounting of compound physical climate risks, exploring how a sequence of extreme weather events such as heatwaves, floods, wildfires, and storms could impact economies, including supply chain breakdowns. The scenarios also integrate climate policy, extreme weather events, economic trends and sectoral dynamics to provide scenarios that reflect the interaction of climate risks and business cycles, the organization added.

Our take: The NGFS's new short-term climate scenarios are a masterclass in model-driven speculation masquerading as actionable insight. By focusing on a five-year horizon, these scenarios aim to inform financial sector stress testing and policy calibration. However, they rely on speculative models that lack empirical grounding. This approach continues the diversion of attention from tangible, data-driven strategies that genuinely enhance economic resilience and human flourishing.

Fossil fuel companies caused $28 trillion in climate damage, study finds

Extreme heat caused by emissions from 111 fossil fuel companies cost an estimated $28 trillion between 1991 and 2020, according to researchers at Dartmouth College.

Their study, which was published Wednesday in "Nature," presents a peer-reviewed method for tying emissions to specific climate harms. Their goal is to help hold companies liable for the cost of extreme weather, similar to holding the tobacco industry liable for lung cancer cases or pharmaceutical companies liable for the opioid crisis.

The research firm Zero Carbon Analytics counts 68 lawsuits filed globally about climate change damage, with more than half of them in the United States.

"We argue that the scientific case for climate liability is closed," wrote the study's authors, Christopher Callahan, who received his PhD from Dartmouth College, and Justin Mankin, a Dartmouth Department of Geography professor.

The researchers figured that every 1% of greenhouse gas put into the atmosphere since 1990 has caused $502 billion in damage from heat alone, which doesn't include the costs incurred by other extreme weather such as hurricanes, droughts and floods. Emissions data is taken from the public Carbon Majors database, they said.

They used 1,000 different computer simulations to translate those emissions into changes for Earth's global average surface temperature by comparing it to a world without that company's emissions.

Our take: The CBS article dutifully parrots an academic exercise in fantasy: assigning $28 trillion in supposed “climate damages” to 111 fossil fuel companies. The irony? None of the extreme weather claims cited have held up under empirical scrutiny—global data show no meaningful increase in hurricanes, droughts, floods, or wildfires. Worse, cold weather still kills far more people than heat ever will, a fact conveniently ignored. The entire field of weather attribution science rests on wildly speculative models riddled with confirmation bias. What we have here is a model-built-on-a-myth designed to produce a preordained villain and dollar figure to feed the propaganda machine. False premises in, false accusations out. It’s pseudoscience dressed up for the courtroom.

Applying the coup de grâce to finally kill battery energy storage systems

However, wind and solar power are highly intermittent, only providing power when nature allows it. Consider the following graphs from the Independent Electricity System Operator’s “Reliability Outlook — An adequacy assessment of Ontario’s electricity system April 2025 – September 2026,” published on March 24, 2025. Wind provides very little power in summer, and solar provides almost none in winter. There are parts of the U.S. that are more favorable for solar, of course, but they all follow a similar trend, resulting in the need to provide huge amounts of backup power for when the wind isn’t blowing or the sun not shining, especially at night.

Concerning the first graph, a 38.7% capacity contribution for a month, for example, means that, on average over the month, consumers can only count on wind power to deliver 38.7% of its rated capacity during peak periods. Concerning the second graph below, a 13.8% capacity contribution for a month means that, on average over the month, consumers can only count on solar to deliver 13.8% of its rated capacity during peak periods.

So, the fundamental, underlying reason for BESS is the supposed climate emergency which is responsible for the massive expansion in wind and solar power illustrated in the first figure in this article. Kill the climate scare and the rationale behind the wind and solar expansion disappears and with it, the primary need for BESS.

As long as politicians and activists can claim the moral high ground by saying that they are saving the climate, many BESS projects will go ahead, no matter the consequences on local communities. But it demonstrates clearly that the climate scare driving these dangerous and costly projects is wholly misguided, and the primary rationale for BESS collapses.

ABSURDITIES

Corporate America Owes the Rest of Us $87 Trillion

Most climate-change deniers don’t even bother fighting the established science anymore: The planet is warming, human activity is the cause, and we can do something about it if we really try. Modern deniers will concede all that, but fire back that the “do something about it” part is too hard, too expensive to be worth trying. We have to be pragmatic, they’ll say, and keep burning fossil fuels to make life easier on people.

The latest clue comes from those known lefty rabble-rousers at the, uh, University of Chicago Booth School of Business and the University of Pennsylvania’s Wharton School. Booth finance professor Lubos Pastor and two Wharton researchers recently estimated that the social cost of the carbon emissions of US companies will amount to a cool $87 trillion through 2050. That was 131% of the total value of corporate equity at the time they measured and about three times the size of GDP.

To come up with their $87 trillion figure, Pastor et al. used the Environmental Protection Agency’s measure of the social cost of carbon. The metric is meant to put a price on the many ways a chaotic climate affects human health, property, social stability, farming and more. That hasn’t been easy or uncontroversial. The first Trump administration pegged the carbon cost as low as $1per ton. Biden’s EPA figured it should start at a baseline of $190 per ton for 2020 emissions and rise every year after, and this was the far-more-realistic scale Pastor's group favored. Trump’s current EPA would prefer to forget the concept altogether.

Suffice it to say that disasters, famines, pandemics, wars and other such apocalyptic horsemen all have an economic impact. Add it up over 25 years of escalating and compounding damages, and $87 trillion starts to seem like a low bid.

Our take: Imagine a serious academic writing a paper that blames one side of an economic exchange for the mythical, model-created damage done by carbon dioxide emissions generated while making all the stuff that makes life tolerable and wonderful - stuff eagerly bought by billions of people. You can’t make this stuff up.