Examining ESG #97 - The Energy Transition Hits a Wall: Ideology Collides with Infrastructure, Economics, and Physics

If 2024 was supposed to be the triumphant year of the energy transition, someone forgot to tell the grids, the markets, and the laws of thermodynamics. This week’s dispatch runs the gamut: from governments betting billions on green tech losers, to negative electricity prices signaling systemic dysfunction rather than success. Daniel Yergin offers a dose of realism, while net-zero policy continues to double down on costly illusions. Meanwhile, even Bloomberg concedes the “clean energy” sector is uninvestable - for now. The central lesson? Rhetoric may be renewable, but reality isn’t.

CHART OF THE WEEK

Our take: Global primary energy consumption has skyrocketed since the 1950s, with fossil fuels—especially oil, coal, and natural gas—still dominating the stack despite decades of climate warnings and green rhetoric. The recent uptick in renewables is visible, but dwarfed by the sheer scale of legacy fuels. In short: change, yes—but proportionally minor for the hugely subsidized “renewables”, and far too slow for the energy transition evangelists to celebrate just yet.

SCIENCE

IPCC misrepresentations: comments made by former IPCC contributors after cutting ties with the politicized body — so scientists no longer subject to professional repercussions.

IPCC scientist #22 - Dr Aynsley Kellow: “I’m not holding my breath for criticism to be taken on board, which underscores a fault in the whole peer review process for the IPCC: there is no chance of a chapter [of the IPCC report] ever being rejected for publication, no matter how flawed it might be.”

Revisiting the global hydrological cycle: is it intensifying?

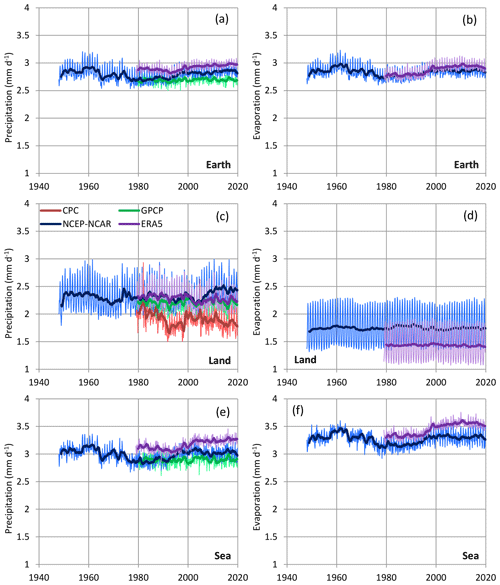

Indeed, Fig. 10, which depicts the evolution of the precipitation rate on Earth and its land and sea parts, based on gauged, satellite and reanalysis information, suggests that precipitation fluctuates through the seasons and also through the years but without a monotonic trend. The marked differences among the various sources of information are also indicative of substantial uncertainty in the estimation of precipitation.

Figure 10Variation of (a, c, e) precipitation and (b, d, f) evaporation. Thin and thick lines of the same colour represent monthly values and running annual averages (right aligned), respectively. Sources of the data are indicated in the legend and detailed in Table 1; GPCP is version V2.3.

Our take: this is just one of the many climate-related factors that the best data indicates is not changing significantly, never mind due to the influence of human-emitted CO2.

If carbon dioxide were the main driver of temperature fluctuations, its concentration variations would have to be enormous. Data from the early decades of the 20th century provide insight into the extent of such fluctuations, particularly in comparison to the warming of the Atlantic period in the mid-Holocene (as discussed earlier). At the beginning of the 20th century, CO2 concentration was around 300–310 ppm. In the 1960s, it was approximately the same as during the Atlantic maximum. Currently, CO2 levels are around ~400 ppm. If this entire difference is attributed to human activity, anthropogenic pressure accounts for no more than 15–18%.

Man is undoubtedly and variously degrading the natural environment. It is absolutely necessary to protect the environment in a RATIONAL manner, without falling into extreme solutions. There are no zero-emission technologies, therefore, each technology determines the use of the earth’s resources, the need for energy, and so on. An equally important pro-environmental measure must be ADAPTIVE, in relation to environmental change.

Read some commentary on this new study here, including:

Past natural climate changes such as Greenland’s “temperature increases of up to 10°C within just 50 years” 14,700 and 11,700 years ago confirm that the modern climate change rate (just 0.05°C per decade since 1860) falls well within the range of natural variability.

Further, a CO2 concentration change from 0.03% to 0.04% (300 ppm to 400 ppm) is not significant enough to impact temperature change in the global ocean, which covers 71% of the Earth’s surface.

“If carbon dioxide were the main driver of temperature fluctuations, its concentration variations would have to be enormous.”

“Currently, CO2 levels are around ~400 ppm. If this entire difference [the ~100 ppm CO2 increase since the early 20th century] is attributed to human activity, anthropogenic pressure accounts for no more than 15-18%.”

Natural factors such as tectonics, changes in galactic phenomena, and the Sun’s magnetic fluctuations continue to modulate climate changes.

Human activity can only play a non-dominant modifying role at most.

Our take: Despite the dogma, the data continue to show that natural rhythms—not human activity—remain the primary drivers of climate variability. The obsession with CO2 as a climate lever is more ideological than empirical, and it’s long past time we acknowledged that.

INVESTMENT/ECONOMICS

Yergin Deftly Deconstructs the Energy Transition Narrative

“Governments simply cannot tolerate disruptions to, shortages of, or sharp price increases in energy supplies. Energy security and affordability are thus essential if governments want to make the transition acceptable to their constituencies. Otherwise, a political backlash against energy and climate policies will occur—what in Europe is known as “greenlash”—the impact of which is showing up in elections. Assuring that citizens have access to timely supplies of energy and electricity is essential for the well-being of populations. That means recognizing that oil and gas will play a larger role in the energy mix for a longer time than was anticipated a few years ago, which will require continuing new investment in both hydrocarbon supplies and infrastructure.” - Daniel Yergin, Vice-Chairman of S&P Global, writing in Foreign Affairs.

Our take: Yergin’s latest dispatch doubles down on a familiar refrain: energy transitions can’t outrun political reality—or voter tolerance for higher prices. His central claim, that this is more “energy addition” than “energy transition,” isn’t new, but it’s now finding a broader audience as governments backpedal on net-zero ambitions. As ever, Yergin frames hydrocarbons not as relics, but as pillars of stability—at least for now. Whether that’s realism or resignation depends on your view of what’s politically possible, and how much time we think we have left.

How to Solve America's Electricity Crisis

America is in an electricity crisis. Shortages are now routine throughout the US—and if we don’t start increasing reliable generation very quickly, our grid will get crushed by the exploding electricity demands of AI.

The first step in solving the crisis is to understand it. At root, our electricity crisis is very simple: government is artificially restricting the supply of reliable electricity—then artificially increasing the demand for reliable electricity.

Government artificially restricts the supply of reliable electricity by destroying, delaying, and defunding reliable power plants.

Here are 5 of the most damaging restrictions on reliable power that need to be reversed.

1. The near-criminalization of nuclear

2. Forced shutdowns of fossil fuel plants

3. Onerous permitting processes

4. Market rules that devalue reliability

5. Subsidies for unreliable power

Our take: This piece pins America’s electricity crisis squarely on government policy—arguing that supply is being strangled by regulation while demand surges from forced electrification. It calls for removing clean energy subsidies, slashing red tape, and prioritizing reliability—namely fossil fuels and nuclear.

Is negative-priced power a good thing?

Finland outpaced all other European markets in 2024 with 725 negatively priced hours, up from just five in 2021 and beating Germany’s 455 hours, according to data from Aurora Energy Research. Limited capacity of high-voltage cables to export electricity meant Finland couldn’t sell more of its excess production to other countries.

In Australia, as there’s been a rapid shift away from coal and massive uptake of household solar, the nation’s main grid has struggled to accommodate supply surges during the brightest hours of the day. Spot power prices fell below zero for a record 23% of the time in Q4 of 2024. Some utilities, including OVO have been offering households free lunchtime power.

Our take: Bloomberg belatedly admits what experts warned all along: rapid renewables growth is destabilizing grids, driving negative prices, and forcing costly curtailments. This isn’t “success”—it’s systemic dysfunction. The media’s years of cheerleading blinded policymakers to basic engineering realities. Now consumers are paying the price for their fantasy-fueled energy narrative.

Plug Power, Which Got A Last-Minute $1.66B Loan Guarantee From DOE, Reports $2.1B Loss

The “green” hydrogen company’s 2024 losses were nearly triple its 2022 losses of $724 million. Given its lousy financial condition, why did the Biden DOE give it a loan guarantee?

In 2021, Plug Power was surfing the wave of hydrogen hype. Its stock was selling for $66 per share, and the company said it was going to replace diesel fuel in transportation systems with “green hydrogen.” One of its presentations claimed, “our sales pipeline is robust and diverse.”

That was four years ago.

Yesterday, Plug reported a $2.1 billion loss for 2024, its stock price is falling, and the company is headed for bankruptcy. As I explained here on January 19, the Loan Programs Office, then headed by Jigar Shah, extended a $1.66 billion loan guarantee to Plug four days before Donald Trump was inaugurated. It announced the deal on January 16. In doing so, it ignored a December 17, 2024, report by the DOE’s Inspector General that urged the agency to halt all loans and loan guarantees until it could ensure that it is complying with “conflicts of interest regulations and enforcing conflict of interest contractual obligations.”

Our take: yet another alternative energy company fueled by taxpayer subsidies destroys billions of wealth that could instead have been improving human lives.

Environmental Levies Will Cost £95 Billion In Next Five Years

Of interest to us is the table for Environmental Levies, which shows that the cost of subsidising renewable energy is set to rocket.

As has been the case for the last few years, they don’t include subsidies embedded in Feed in Tariffs, which they used to count as Levies. So I have included them in the modified table below, along with the Climate Change Levy imposed on electricity and gas bills for businesses, which are separately shown in Table 3.9:

In total therefore, the various subsidies and levies will cost £17.1 billion this year, rising to £19.8 billion in 2029/30. This will be £5.0 billion more than last year.

Given that all of this, except for RHI, is loaded on to energy bills, it is not credible that bills will fall by £300 a year, as Labour promised.

Neither do these costs include the massive extra costs of balancing and upgrading the grid required to meet Labour’s Clean Power 2030 objective, as already highlighted by NESO.

The strike price for new offshore wind projects agreed last year is around £84/MWh at 2025 prices, and will likely rise to over £90/MWh by they time they begin operating in four or five years time.

This demolishes claims that they are cheaper than gas generation.

Our take: as noted a number of times in this space, the UK has swallowed the net zero ideology more than most, and economic stagnation combined with a rising cost of living is the result. The government seems furiously determined to avoid what their own numbers say. You can avoid facing reality, but not it’s consequences.

Net zero insulation plan won’t pay off for 100 years, Government admits

Insulation was installed in 14 homes in Yorkshire, at a cost of up to £44,000 per house, for the research conducted by Leeds Beckett University for the Department for Energy Security and Net Zero (DESNZ).

The £2.8 million study focused on homes with solid walls, which account for more than a quarter of British homes and are amongst the most difficult to insulate.

Overall, it found that the energy efficiency measures would not pay back in terms of reduced bills for many decades, and commonly more than 100 years.

The National Wealth Fund this week announced a £400 million backing for loans to insulate social housing and install heat pumps.

Meanwhile, landlords are expected to spend up to £15,000 to upgrade their homes to an energy performance rating of C, to save renters up to £240 a year, a payback period of more than 60 years.

Harry Wilkinson, of the Global Warming Policy Foundation, said: “The straitjacket of net zero forces the Government to attempt to direct vast swathes of the economy, an activity that is doomed to fail.

Our take: indeed, as the last quote says, centrally planned economies are doomed to fail.

Where does the ‘energy transition’ end?

This post attempts to explain what happens when you take an electricity grid powered exclusively by gas turbines, and progressively add windfarms. Will you save money? The answer is, ‘It depends’.

As you add more and more windfarms to the system, their average output starts to decrease. This is because, at first occasionally, and then more and more frequently, the total output of the windfarms will be higher than demand. Since that is never allowed on grids, the windfarms will have to be curtailed.

After this point is reached, each new windfarm effectively brings less output, but the same cost, to the system. Unit costs and selling prices therefore have to go up.

The figure below is the output of a simplified model of an electricity grid, showing this effect.

At low gas prices, as the first windfarm is added (at the left-hand side), the system cost increases. As further windfarms are added, the costs just go on rising. This is effectively the situation we have been in for most of the last 25 years. Current gas prices are around 100p/therm and, if they stay the same, we should expect electricity prices to increase steadily.

Our take: net zero advocates continue to say their windmills and solar panels are cheaper than traditional forms of electricity generation like fossil fuels, yet as their pet projects are implemented costs keep rising. They insist that if only more money is spent then costs will come down, and can’t see the obvious contradiction. What mental processes allow them to persistently deny reality? Could it be their ideology is blinding them?

Supreme Court declines appeal from youths seeking to force action on climate crisis

The Supreme Court on Monday declined to take up a long-shot appeal from a group of minors who have for years been attempting to force the federal government to address climate change.

Filed by 21 children and teenagers in 2015, the lawsuit alleged that the federal government’s energy policies unconstitutionally deprived them of their “fundamental rights to life, liberty, personal security, dignity, bodily integrity, and their cultural and religious practices.”

The group has repeatedly lost in federal courts and the question for the justices was a procedural issue dealing with whether the group had established standing to sue. The 9th US Circuit Court of Appeals ruled that the group does not and it had ordered a federal district court to dismiss the case.

Our take: first, there is no way a bunch of children and teenagers have enough knowledge to begin assessing the scientific questions of climate change, the economic implications of related policies, nor the morality of government coercion to implement such policies. It was adults abusing children who launched this suit. Second, the notion that carbon dioxide, the gas of life, is depriving children of life, liberty or anything else is absurd. This will not stop other similar lawsuits but hopefully it will set them back and reduce their number.

ABSURDITIES

Bloomberg: Clean Energy Sector is 'Dead for Now'

There is currently no money to be made from things like wind and solar, a hedge fund set up specifically to profit from that niche has concluded.

“The whole sector — solar, wind, hydrogen, fuel cells — anything clean is dead for now,” Nishant Gupta, the founder of the UK-based fund, Kanou Capital, told Bloomberg, hours after one of the largest solar energy players in the U.S. warned it has doubts about its state as a going concern.

Our take: Kanou Capital’s verdict is blunt: clean tech is uninvestable—for now. With subsidies drying up, interest rates climbing, and grid realities biting, wind and solar’s once-hyped profitability has evaporated. The long-term case might yet remain intact, but in the short run, the energy transition is running hard into political, financial, and physical limits.