Examining ESG #99 - Droughts, Blackouts, and Billion-Dollar Blunders: The Real Cost of Net Zero

We begin with IPCC contributors admitting the political tampering of climate “summaries,” while drought monitoring systems continue to show no CO₂-driven trend—just good old-fashioned weather. Meanwhile, revised crop yield data undercuts the inflated Social Cost of Carbon, and historical snowfall in Ottawa quietly buries the climate apocalypse narrative. On the investment front, the oil under America’s feet dwarfs global consumption, yet ESG-aligned bureaucrats and politicians still double down on policies that penalize abundance. From Texas grid instability to French oversupply fiascos and Britain’s energy suicide, the pattern is clear: net-zero plans promise utopia but deliver economic erosion, energy unreliability, and moral confusion. The science isn’t settled, the benefits aren’t measurable, and the risks are real.

CHART OF THE WEEK

SCIENCE

IPCC misrepresentations: comments made by former IPCC contributors after cutting ties with the politicized body — so scientists no longer subject to professional repercussions.

IPCC scientist #24 - Dr Hans Labohm: “The alarmist passages in the IPCC Summary for Policymakers have been skewed through an elaborate and sophisticated process of spin-doctoring.”

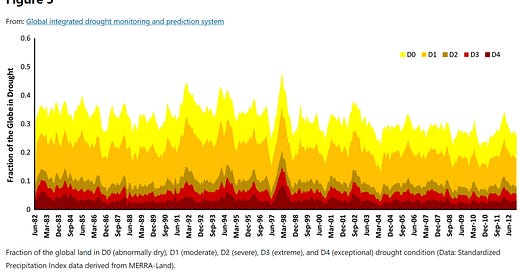

Global integrated drought monitoring and prediction system

Drought is by far the most costly natural disaster that can lead to widespread impacts, including water and food crises. Here we present data sets available from the Global Integrated Drought Monitoring and Prediction System (GIDMaPS), which provides drought information based on multiple drought indicators. The system provides meteorological and agricultural drought information based on multiple satellite-, and model-based precipitation and soil moisture data sets. GIDMaPS includes a near real-time monitoring component and a seasonal probabilistic prediction module. The data sets include historical drought severity data from the monitoring component, and probabilistic seasonal forecasts from the prediction module. The probabilistic forecasts provide essential information for early warning, taking preventive measures, and planning mitigation strategies. GIDMaPS data sets are a significant extension to current capabilities and data sets for global drought assessment and early warning. The presented data sets would be instrumental in reducing drought impacts especially in developing countries. Our results indicate that GIDMaPS data sets reliably captured several major droughts from across the globe.

Our take: as anyone who looks at the data would know, extreme weather events like drought are not on a long-term increasing trend, never mind increasing due to human emissions of CO2. How long will it take until financial companies do a proper due diligence and discover their push for net zero/ESG/sustainability has been based on easily disprovable alarmist claims?

Extended crop yield meta-analysis data do not support upward SCC revision

The Biden Administration raised its Social Cost of Carbon (SCC) estimate about fivefold based in part on global crop yield decline projections estimated on a meta-analysis data base first published in 2014. The data set contains 1722 records but half were missing at least one variable (usually the change in CO2) so only 862 were available for multivariate regression modeling. By re-examining the underlying sources I was able to recover 360 records and increase the sample size to 1222. Reanalysis on the larger data set yields very different results. While the original smaller data set implies yield declines of all crop types even at low levels of warming, on the full data set global average yield changes are zero or positive even out to 5 °C warming.

Our take: the social cost of carbon (SCC) is one of the inventions of people who demonize carbon dioxide, in an attempt to build the appearance of scientific credibility. Never mind the fact that the social cost of alternatives to carbon is immeasurably high, these carbon dioxide alarmists can’t even do their statistics properly.

Ottawa snow days and freezing days - what the measurements show

Now that the Canadian federal election is over along with a long winter, it seems like a good time to look at the historical snow record in Ottawa. Surely, over the last few decades with all the warnings about “the end of snow” due to global warming, with “global burning” due to the climate crisis, and with “oceans boiling, ” surely the number of snow days in Ottawa must be close to zero, or at least headed there, right? Not so much.

When you look at the statistics from https://ottawa.weatherstats.ca/charts/count_snow-yearly.html it certainly appears to the eye that the bars towards the right side are bigger than the left side, thus more snow days.

But surely the number of days when the temperature is below zero has to be decreasing as the planet warms due to all those anthropogenic emissions of CO2, right? Strangely, no, even though a slight warming due to the urban heat island effect would be expected as the population and infrastructure of Ottawa has increased greatly over the last 150 years.

INVESTMENT/ECONOMICS

In the tiny pore space of shale rock, connected over miles, with a combined volume for current US shale plays that is larger than Lake Erie.

There are six shale basins in the USA under production development that are rich in oil. These basins are connected through the Western Interior Seaway that ran between ND and TX, 65-100 million years ago - a shallow sea like the Mediterranean today.

Dead plants, algae and plankton mixed with tiny rock particles as they sank to the bottom of the sea to create shale, and then this organic soup (kerogen) cooked in Mother Nature’s pressure cooker to become oil and gas.

The average US shale “reservoir” is 93% rock, and the rest is open space, porosity, filled with oil and water - about 3% water and about 4% oil.

To calculate an oil column that may be present in a shale basin, multiply oil saturation with porosity and formation thickness (SoPhiH), or oil percentage with the average (combined) thickness (for multiple pay zones) of 560 ft. That’s a 19 ft oil column over a combined 55,000 square miles of oil-rich shale basin

Or think of this “reservoir” as a 19 ft deep and giant swimming pool of oil over an area the size of the state of New York.

Or Oil in Place (OIP) of more than 4 trillion barrels in these existing shale plays is about three times larger than all the oil the world has consumed to date.

Or looking at it one another way, OIP is 160 cubic miles of crude oil. That’s slightly more than the water volume in Lake Erie.

Our take: oh, but we thought peak oil was to happen a couple of decades ago. Few people realize how abundant fossil fuels are, so long as scientists, engineers and entrepreneurs are free enough from the coercive, anti-development, climalarmist efforts to stop them, to turn rock into life-giving energy.

Climate Risk and ESG for Corporate Governance and Decision-making Micro-certificate

The Canada Climate Law Initiative has partnered with the Allard School of Law at the University of British Columbia to bring you a flexible 8-week online educational program. The micro-certificate will provide directors, officers, in-house and external legal counsel, and governance professionals with the in-depth legal literacy and knowledge of governance practices for managing climate-related financial risks and key regulatory requirements in corporate, securities, pension, and environmental law, with a particular focus on Canada.

Our take: and, like every similar program we have located so far, it appears to be essentially lacking in scientific due diligence on the underlying assumptions of the whole program, instead accepting a hodge-podge of disproven, alarmist, political ideas and turning them into continuing education. Not only has finance been taken over by such bad ideas, as evidenced by the CFA Institute’s certificate in Climate Risk, but law schools are on board too. Lawyers and investment professionals are supposed to excel at searching for objective facts, but are instead captured by ideology.

Mario Loyola writes in the WSJ, Texas is facing a crunch in its electricity supply because of a massive build-out of heavily subsidized wind and solar energy. Renewables subsidies force reliable resources like natural gas, coal and nuclear to sit idle for hours on end, making it harder to recoup costs and stifling investment.

Meanwhile, more than $130B has flowed into renewable resources that can't be counted on to produce electricity when needed. Texans found this out the hard way in 2021, when blackouts killed hundreds during Winter Storm Uri. Residential electricity prices are now higher in Texas than in Florida, a state that gets most of its electricity from natural gas produced in Texas and Louisiana.

The Texas Legislature has responded by requiring renewable energy plants to secure their own firm backup supply. HB 1500, a law passed in 2023, introduced a “firming" requirement, but that applies only to new power plants starting in 2027. It’s too little, too late, and does nothing to reduce the enormous costs and distortions that existing wind and solar impose on the grid.

So the Legislature is now considering a new bill, SB 715, which would apply the firming requirement to all sources, old and new, and accelerate implementation. It isn't a moment too soon. Texas has dug a deep hole for itself, and every day the IRA subsidies are in effect, the hole gets deeper. Since 2000, Texas has added nearly 80 GW of intermittent renewable resources—wind and solar—largely due to federal renewable tax credits, about four times the fossil energy Texas has added since 2010.

Given the soaring demand forecasts, construction of new natural gas and coal plants should be booming. Instead, while the Texas grid has expanded greatly in nominal capacity, the dispatchable capacity required for affordable and reliable electricity has barely edged upward.

HB 1500 aims to alleviate these issues by requiring new power plants to meet strict reliability standards or incur financial penalties. HB 1500 also forces renewable projects—often located far from existing transmission infrastructure—to bear more of the costs of new transmission, instead of imposing those costs on Texas ratepayers as they've been doing for years.

Renewable investors will cry foul if SB 715 passes, but they knew that the lavish subsidies were controversial and could be eliminated at any time. They assumed the risk. After Senate passage, SB 715 now faces an uncertain path in the Texas House. The stakes are high.

Our take: Texas is learning—expensively—that you can't subsidize your way to grid reliability. For Canadian investment managers, the takeaway is clear: investments distorted by subsidies and shielded from market discipline may shine on ESG scorecards, but they crack under real-world demand.

CSA updates market on approach to climate-related and diversity-related disclosure projects

The Canadian Securities Administrators (CSA) is pausing its work on the development of a new mandatory climate-related disclosure rule and amendments to the existing diversity-related disclosure requirements. This is being done to support Canadian markets and issuers as they adapt to the recent developments in the U.S. and globally.

“In recent months, the global economic and geopolitical landscape has rapidly and significantly changed, resulting in increased uncertainty and rising competitiveness concerns for Canadian issuers,” said Stan Magidson, Chair of the CSA and Chair and CEO of the Alberta Securities Commission. “In response, the CSA is focusing on initiatives to make Canadian markets more competitive, efficient and resilient.”

Climate-related risks are a mainstream business issue and securities legislation already requires issuers to disclose material climate-related risks affecting their business in the same way that issuers are required to disclose other types of material information. The Canadian Sustainability Standards Board (CSSB) issued their inaugural sustainability standards in December 2024, which are generally aligned with the standards issued by the International Sustainability Standards Board. The CSSB standards provide a useful voluntary disclosure framework for sustainability and climate-related disclosure that issuers are encouraged to refer to when preparing their disclosures.

Our take: The CSA’s decision to pause its mandatory climate and diversity disclosure initiatives is a rare moment of regulatory restraint that potentially acknowledges two key realities: the economic headwinds facing issuers, and the diminishing credibility of ESG-aligned policy. We might hope the CSA has finally read the fine print on Net Zero, where global emissions cuts avert an undetectably small temperature change, as shown by Lindzen and Happer's work (0.07°C globally by 2050). It’s telling that material climate risks are already required under existing securities law, yet activists demand special treatment for climate as if it’s a different species of risk. That’s not disclosure, it’s doctrine. The CSA’s pause isn’t just pragmatic. It’s a small but welcome rebuke of the ESG orthodoxy.

NYC Pension Funds to Drop Asset Managers Without Strong Net Zero Action Plans

New York City Comptroller Brad Lander announced that he was increasing demands on asset managers for the city’s pension system – collectively the fourth largest public pension plan in the U.S. – to align their investments with the city’s climate goals, including requirements to submit strong net zero action plans, and to set expectations for all portfolio companies to set full value chain net zero goals.

Lander, a candidate in the upcoming NYC mayoral race, said that asset managers who fail to submit sufficiently strong net zero plans will be replaced.

According to Lander, the net zero plans will be evaluated based on requirements for asset managers to engage portfolio companies to drive real economy decarbonization, rather than just decarbonizing portfolios, to incorporate material climate change-related risks and opportunities in investment decision-making, and to put in place a stewardship strategy addressing prioritization and escalation of engagement and voting to advance decarbonization.

The Comptroller also said that asset managers should set expectations for portfolio companies to measure and report Scopes 1, 2 and 3 emissions and to set clear net zero goals by decreasing those emissions, in addition to adopt their own net zero plans to meet short-, medium- and long-term climate goals, align their future capital expenditures and lobbying with climate goals and targets, and to consider the impacts from transitioning to a lower-carbon business model on workers and communities .

Our take: New York City’s Comptroller is now tying $280 billion in pension fund management to allegiance with a political climate agenda that, according to empirical research, would deliver near-zero measurable benefits to the climate. What’s marketed as fiduciary duty is really ideological screening, where investment performance takes a back seat to the optics of ESG.

What makes California possibly interesting is a growing consensus even among the Democrats who dominate state government that their beloved environmental-protection machinery is a threat not only to all sorts of useful development but even to their environmental-protection agenda. Having tried everything else, will the pols now liberate Californians to create abundance?

When legislators passed the California Environmental Quality Act in 1970, it was considered a modest regulation, meant to ensure that government agencies considered how public projects could impact the state’s residents, wildlife and natural resources.

Since then, the law’s scope has massively expanded. Today, CEQA (pronounced “see-qwa”) provides an easy path to legally challenge almost any project — public or private, large or small — on environmental grounds.

It’s a favored tool among special interest groups — from NIMBY neighbors looking to stop growth to labor unions trying to negotiate agreements.

But the use of CEQA as a legal cudgel has lead to major delays, escalating costs and, in some cases, has killed projects entirely.

In a separate story this week, Ms. Talerico writes about how the state’s environmental law is crushing the state’s environmental agenda, and specifically its signature high-speed rail project. Not that this boondoggle doesn’t deserve to be crushed given its harm to taxpayers, but it’s still striking the way green rules are killing green dreams.

Our take: California’s regulatory contradictions are finally colliding with reality. If even one-party rule in Sacramento is starting to grasp that environmental “protection” has become a barrier to environmental progress—and to human flourishing—that’s a hopeful signal. But let’s not confuse the bureaucratic reshuffling of CEQA with genuine abundance; true abundance requires the unleashing of markets, not the redirection of red tape.

UK’s mad energy policy is a potent deterrent to foreign investors

It is hard to overstate quite how mad the UK’s energy policy looks to outsiders. Investors are scrambling to redirect their capital into other countries after years of over-allocating to the United States. This is a generational opportunity for a British economy that has run an investment-light model for 40 years — and yet, when marketing these islands as an investment destination, many investors struggle to square the government’s primary mission for economic growth with a penal 78 per cent tax rate on energy profits and a commitment to no new licences for the UK’s North Sea continental shelf. That approach looks like an irrational own goal. It is an impediment to economic growth and prosperity that is hiding in plain sight.

There are two aspects to the hiatus on North Sea exploration that appear deeply irrational to investors.

The first is emissions. Investors fully recognise the global imperative to decarbonise but in reducing domestic supply of oil and gas the UK is, in fact, adding to carbon in its energy mix. It does this by increasing its reliance on dirtier foreign imports. Approximately a third of the UK’s gas demand comes from imported liquefied natural gas from the US and Qatar. At 79kg of carbon per barrel of oil equivalent (BOE), this has almost four times the carbon intensity of UK production at just 21kg/BOE. The processes of liquefaction and transportation across the seas are both carbon-intensive. A straight replacement of imported LNG by domestic supply would diminish the UK’s total carbon footprint and reduce the offshoring of UK emissions.

The second irrationality is the perverse fiscal implications of limiting North Sea exploration at a time of tight public finances. Reduced domestic production raises decommissioning charges for taxpayers, estimated at £24 billion over the next decade, and reduces Treasury tax revenues. The Laffer curve, where a hypothetical cut in the tax rate generates more in tax revenue, is often cited in UK economic discourse with little empirical support, but at 78 per cent — the marginal tax rate on North Sea energy profits — we are in clear Laffer territory. At a time when the government is facing fiendishly difficult decisions on public spending and tax, leaving tax revenue on the table is an odd approach, to put it mildly.

Our take: the article rightly exposes the economic masochism of Britain’s punitive energy policies, but could be more forceful about the deeper absurdity: crippling domestic production while importing dirtier foreign fuels is not just bad economics, it’s bad environmentalism. From a human flourishing perspective, taxing energy at 78% while strangling supply starves investment, prosperity, and energy security — the lifeblood of a civilized society. As Lindzen, Happer, and others have documented, Net Zero measures, even globally, avert negligible warming, rendering such self-harm both scientifically and morally indefensible. Britain's "energy suicide" hides behind the false virtue of climate policy but delivers real-world misery.

France paid €12,000/MWh to get rid of excess power

That’s how strained the French grid has become — not from a lack of energy, but from too much of it.

A mix of soaring solar capacity, strong nuclear output, and weak spring demand has created major oversupply issues. In response, TSO RTE has been forced to:

Trigger costly emergency balancing mechanisms

Curtail renewable generation almost daily

Call on European neighbours to take surplus electricity

“This issue will likely last until at least mid-June,” says Clément Bouilloux, Head of Montel Analytics France. Negative power prices – typically seen in summer – are now showing up as early as March.

More storage, flexible demand, and upcoming regulations may ease the pressure in future. But for now, balancing the grid is a daily challenge.

Our take: as previously noted, negative prices are not good, and instead indicate a profound imbalance between supply and demand that destroys capital. This is what happens when you add non-dispatchable generation to a grid - power that can surge on and off without controls, and which forces you to modulate the sources you can control, making them less efficient. Then sometimes you have to pay large amounts to stop the power generation or pay to get another grid to accept it.

Have The Intermittent Energy Blackouts Begun?

For years, many in the climate skeptic community have warned that expansion of intermittent renewable electricity generation on the grid will, sooner or later, lead to frequent blackouts. The reason for the warning is easy to understand: The grid has some rather exacting operational requirements that the intermittent renewable generation technologies cannot fulfill. Primary among these requirements are, first, minute-by-minute matching of electricity supply with electricity demand and, second, grid-wide synchronization of the frequency of the alternating current. When wind and solar provided relatively small portions of the electricity consumed, other generation sources, particularly thermal (fossil fuel) and hydro, would fulfill these requirements. But as wind and solar come to dominate generation, the problems become much more difficult to solve.

[S]ome analysts have suggested that the Spanish grid operator's reliance on renewable energy sources to supply the majority of the nation's electricity could have led to the blackout. Traditional generators, like coal and hydroelectric plants or gas turbines, are connected directly to the grid via heavy spinning machines. When turned on, these massive machines are in constant motion and the inertia created by their weight and momentum acts like a shock absorber, helping to insulate the grid against a sudden disturbance - for example, in the event of a transmission failure. Solar and wind power do not provide the natural inertia generated by these so-called 'spinning machines', leaving the grid more vulnerable to disruptions and subsequent oscillations in the electrical frequency.

[A]ll of Europe appears to have been seconds away a continent-wide blackout. The grid frequency across continental Europe plunged to 49.85 hertz — just a hair above the red-line collapse threshold. The normal operating frequency for Europe’s power grid is 50.00 Hz, kept with an extremely tight margin of ±0.1 Hz. Anything outside ±0.2 Hz triggers major emergency actions. If the frequency had fallen just another 0.3 Hz — below 49.5 Hz — Europe could have suffered a system-wide cascading blackout.

Our take: grid momentum is just one of the risks of adding too much solar and wind to a previously stable grid. It will be interesting to see how many other locations desperately try ramping up natural gas generation in the face of solar and wind unreliability, only to see their grid crash due to a lack of reliable power generators.

ABSURDITIES

Canada can no longer afford to indulge in net-zero nonsense

Let’s be honest with ourselves; Canada’s economy will never be net-zero.1 It is a fantasy developed and promoted by progressives and globalists (but I repeat myself) that will not happen because it defies the laws of physics and the realities of economics and human behaviour. Don’t take my word for it; this is a conclusion reached by energy luminaries including Daniel Yergin and Vaclav Smil. The sooner Canadians get past this fallacy that has been baked into policy discussions for far too long, the sooner we can get moving to rebuild our national economy by exploiting our competitive advantages—in particular, the abundance of resources in this country.

There have been several energy transitions over human history, from wood to wind to coal to fossil fuels to nuclear. But there has never been a case of humanity reverting from a more energy-dense form of energy to one that is less dense. Past energy transitions meant better performance at lower cost. In contrast, renewables offer less reliability at a higher cost. While solar and wind development makes sense in some applications, their intermittency means that they typically need to be backed up with dispatchable capacity, usually natural gas, in order to provide the grid uptime that we expect in a modern society. All-in cost of deployment is thus often much higher than reported.

Fossil fuels should be seen as highly concentrated forms of solar energy, stored in coal, oil, and natural gas. They are what built modern civilization. Many things we take for granted just cannot be electrified or made to work using low-density forms of energy. Examples include air travel, road paving, cement production, steel manufacturing, petrochemicals, shipping, long-haul trucking, and peaker plant electricity. Inherent limits to scalability, intermittency, and low energy density make renewables impractical for many such applications. That’s why the amount of fossil fuels burned in the world continues to rise in absolute terms and has only dropped by a tiny percentage in relative terms over the last three decades, despite trillions of dollars being spent on the “energy transition.”